3 Stocks Sitting at Make-or-Break Zones This Week (July 29 2025)

Hello and welcome to another edition of Zone Alerts!

Still no Quantamentals this week… and here’s why:

Turns out, a lot of you have been missing the old format a little too much.

So, with the market looking like it’s about to shimmy out of this months-long (wait, has it really only been months??) tariff tightrope… we’re staying the course.

This issue, we’ll be looking for:

a) stocks that have been bucking the market’s upward trend but may soon join the party as clarity improves; and

b) stocks that have ridden this rally a little too hard—and could soon face a quick reality check.

And we’ll be using our trusty Zone Scanner to spot them. Let’s get to it.

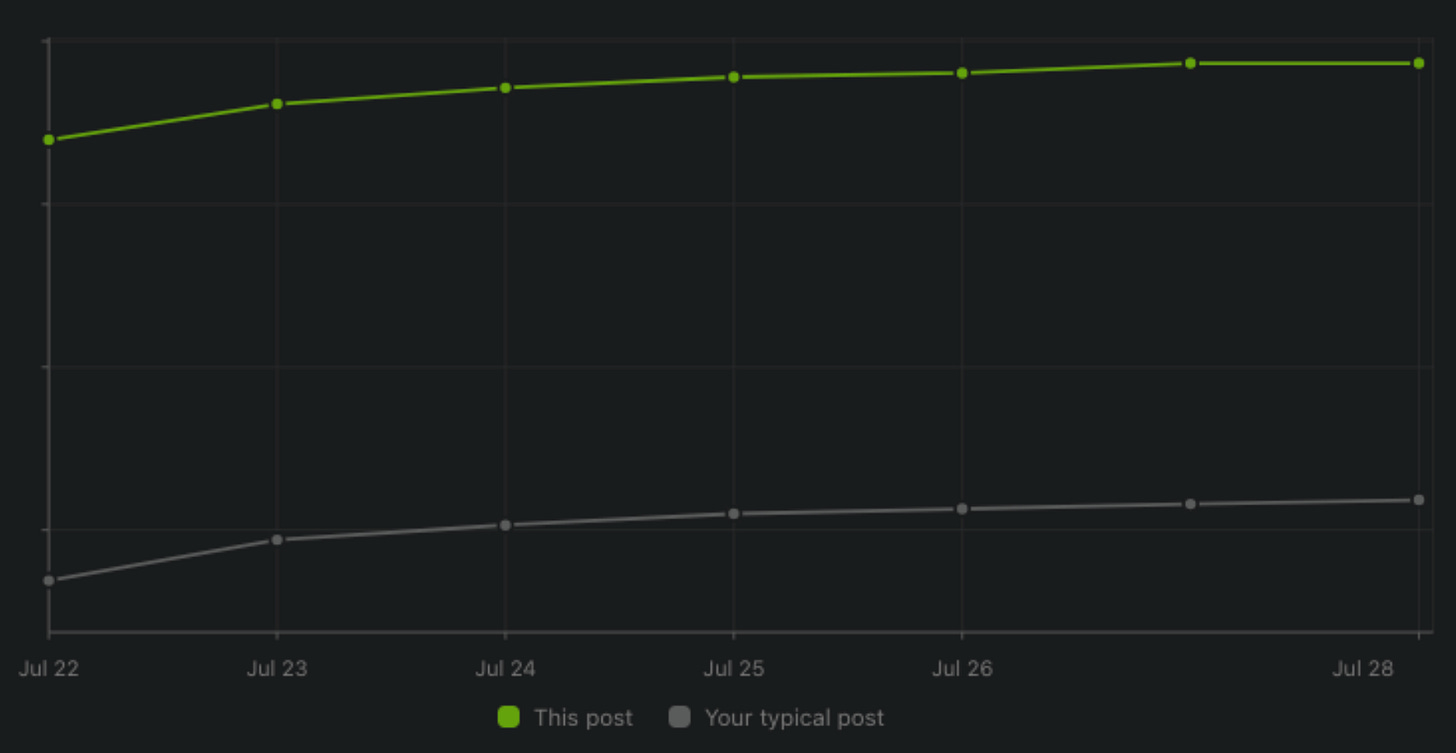

Enjoying this format of Zone Alert?

🖤 Give this post a like to let us know!

We’d love to hear your thoughts—join our subscriber community to drop your feedback. You can help us shape what comes next!

What’s in this issue:

• High-potential opportunities

• This week’s most actionable setup

This week’s hot setups

Assurant Inc. (AIZ)

Financial • Insurance - Property & Casualty • USA • NYSE

View full chart

While most of its Financials brethren have been strutting their stuff as of late, AIZ has been quietly drifting lower since early June—its P/S ratio now relegated to the 8th percentile vs the sector.

For the past couple weeks, the stock has been idling right at its May 2024 support zone—a level that’s been catching its dips since last September.

Apart from that strong base, there’s honestly not a ton going on with AIZ’s technicals. But with more trade and market clarity (hopefully) coming soon, this zone could be the launchpad for this laggard to catch up with everyone else.

If a bounce occurs and AIZ reclaims the September 2024 zone, we could be looking at a potential 9-12% gain.

Equity Residential Properties Trust (EQR)

Real Estate • REIT - Residential • USA • NYSE

View full chart

Since May, EQR hasn’t exactly been lighting up any screens. It’s been on a limp sideways shuffle that, in most cases, wouldn’t get a second gaze.

But look a little more carefully and you’ll see that the zone it’s currently consolidating in has history—it’s actually been around since the Obama administration. And in more recent years, it’s been acting as a pretty solid deterrent to penetrations—both up and down.

With more economic stability potentially setting in, a decent earnings print next week could trigger some reversion for EQR.

Plus, because the stock hasn’t seen much attention lately—valuation-wise, it’s now fallen to the very low percentiles relative to its 10-year range…

Making this July 2012 zone a potentially strong entry point for a long.

Stryker Corp. (SYK)

Healthcare • Medical Devices • USA • NYSE

View full chart

SYK has been running wild lately—up more than 20% off its Liberation Day lows and currently flirting with its 52W high of $406.19.

The problem is, its doing so while carrying some of the heaviest valuation baggage in the entire US market.

And right now, it’s about to bump up against the roof of its November 2024 resistance zone while heading into earnings.

If results disappoint, it could trigger a quick SYK drop down to the September 2024 support zone. On the other hand, if it rips through resistance… best step out of the away.

That’s it for today’s issue of Zone Alert. We’ll be back next week with fresh setups nearing key zones.

In the meantime:

Want to find more immediate setups?

The Trading Places platform is live—and free! Head on over and check out the Zone Scanner and Live Hot Picks.

Disclaimer: This isn't financial advice. This shouldn’t be news to you.