Blood in the streets? (22 Dec 2024)

What. A. Week.

Between JPow causing millions of people to panic-soil themselves, Friday’s triple quad witching event, and an almost-government shutdown—market volatility this week felt like it should’ve come with a medical waiver.

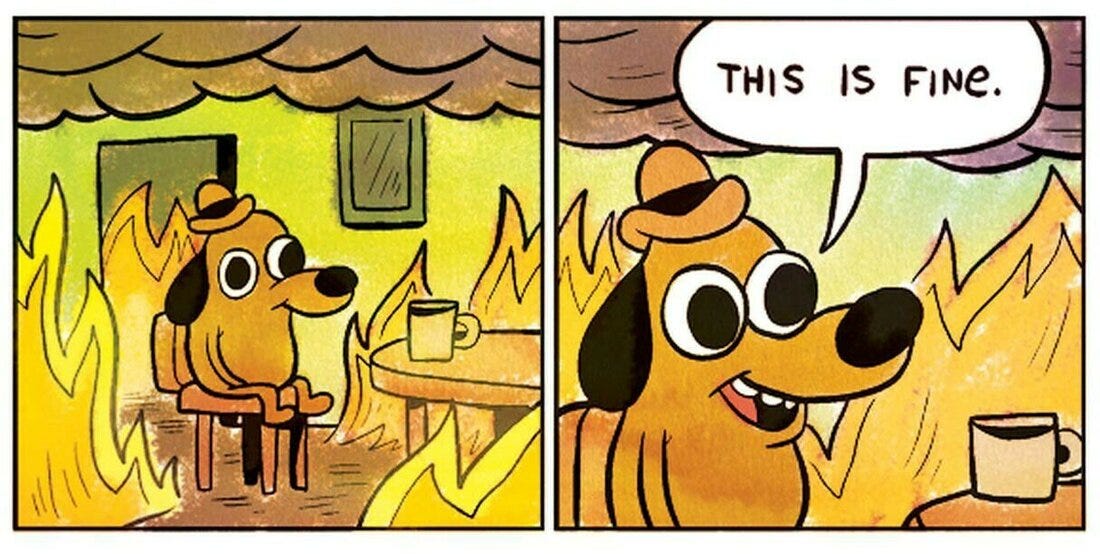

Nonetheless, what could’ve been an all-out dumpster fire of a week merely ended being just… ‘bad.’ The VIX managed to close below 20 as traders realized they’ve got plenty of other crap to worry about.

Which kind of makes sense, in a nonsense kind of way.

The market’s gonna market no matter what, and everybody knows it. Our collective tolerance for Cray-Cray has gone up significantly.

So until proven otherwise…

Our last zones

We dropped our very first zone signals earlier this week—literally the day before The Hawk-ening. Talk about going hard mode on the first go.

Here’s how things shook out:

Paychex Inc (PAYX)

Last we checked, PAYX was hovering near the middle of its 138-144 zone, looking just about ready to restart its uptrend.

But with its Q2 earnings coming out just days away, our call was: anything goes. Very helpful, indeed.

The report has since been released, and it went swimmingly—slightly beating expectations.

Right now, the stock’s back at pre-Fed announcement levels. Probably the best it could hope for given what happened tbh.

Lockheed Martin Corp (LMT)

The Edges of a zone is where the action happens.

With LMT hanging around near the top of its 462-499 support zone AND having an RSI of 23, we thought the stock looked quite interesting.

But we also thought it’s still likely to make a quick visit to the bottom of the zone before kicking back up.

Seems we won’t need to wait that long.

“But wait, who the f are you people and what am I doing here?”

Welcome to Trading Places.

We’re just a bunch of market nerds, quants, and posers who’ve stared at enough charts we dump our portfolios at the sight of a menorah.

After years of convincing ourselves that the lines and shapes we were plotting actually meant something, we finally figured it was time to upgrade our shtick a tiny bit.

So now, we get quant intelligence to do it for us.

We built an algorithm that’s deaf to the market’s siren songs. It cuts through the BS and pinpoints Zones of interest, i.e. places on the chart where actual money comes to dance.

Think of it as a Limitless pill for your stock, currency, and crypto plays—scanning the markets in real-time and determining where the action’s at.

Incoming!

Here’s what our Zone Scanner flagged this weekend:

Resmed Inc (RMD)

Healthcare • Medical Instruments & Supplies • USA • NYSE

RMD first caught our eye on December 20, when it checked all our Post-Hawkening boxes:

Appeared in our scanner (meaning it’s approaching a zone)

Got rekt by JPow

Price landed near the Edge of a zone

Didn’t penetrate said zone and remained in play throughout the week

It did, however, close the week breaking through its 231-237 zone (currently at $237.27) and could make a run toward the next one at 245-255.

Prologis, Inc (PLD)

Real Estate • REIT - Industrial • USA • NYSE

While relatively stable with pretty solid revenue growth, PLD’s premium valuation compared to its REIT peers has made the stock unappealing to a lot of traders.

This decline, though, has brought the stock all the way down to this trampoline of a zone at 101-103.

Seriously, just look at how bouncy it’s been the last couple years:

With the stock having already dipped to the bottom of the zone and closing the week slightly above it, a turnaround could be just around the corner.

Regeneron Pharmaceuticals, Inc (REGN)

Healthcare • Biotechnology • USA • NASD

REGN has been in a bit of a free-fall as of late, after suffering a legal setback in September.

Their request to have Amgen’s (NASDAQ:AMGN) ‘biosimilar’ version of an ophthalmology drug blocked was denied by a federal court—allowing the latter to potentially threaten their market share and pricing power.

Gotta give it to Big Pharma, though. When it comes to screwing everyone over… they really mean everyone.

On the bright side (sorry, bagholders), this meant the stock is now sitting in the 3rd percentile P/B vs its 20-year history. Simply put, it’s cheap af.

And like PLD, it’s lying on a strong zone. One that hasn’t been broken since late 2023.

WTF are Zones, anyway?

Zones are key price levels where the market has reacted strongly in the past—such as sharp reversals or sudden swings.

They’re areas where actual supply and demand met in the past, and likely will meet again.

“Why are these significant?”

Well, it all comes down to three key principles. We like to call them The Principles of:

When I Dip, You Dip, We Dip (aka psychology)

Traders are aware that others are watching these levels (zones) too. With everybody paying attention, this creates a self-fulfilling prophecy where everybody acts in anticipation of everybody else’s actions.

Markets Gonna Market ¯\_(ツ)_/¯ (aka technical factors)

If the first price rejection at the top of a zone was violent, it’s likely that buyers who entered at that level are now holding losses.

But with each retest, the rejection weakens, as there are fewer buyers remaining underwater. This weakens that resistance (or support for all you short-sellers), and could eventually lead to a break through.

Killer Whales (aka institutional plays)

Big players need liquidity in order to place massive orders without moving the market against themselves. So they wait for these zones, knowing a lot of us small fry (retail traders) will come to play.

This allows them to buy low or sell high without causing a lot of waves.

But remember: Zones are NOT guarantees but rather regions of increased probability for market moves. So always, ALWAYS use proper risk management.

Trading Places: Launch coming soon!

Stop obsessively refreshing your charts like it’s your ex’s Instagram.

By combining historical patterns with real-time market data, Trading Places identifies zones and assigns probabilities to each one—helping traders spot potential plays with higher chances of success.

It automates all of the curation, chart-plotting, and alerting for you, so you can actually have a life (or at least pretend to)!

Stay tuned!

Disclaimer: This isn't financial advice. Why would you think it is? We don’t know your life.