Hot zone alert - April 29 2025

Your weekly guide to the the most promising trade setups in stocks, crypto, and currencies

GM friends, welcome back to Zone Alert!

But before we proceed with this week’s charts—some quick New Feature Alerts for our beta users:

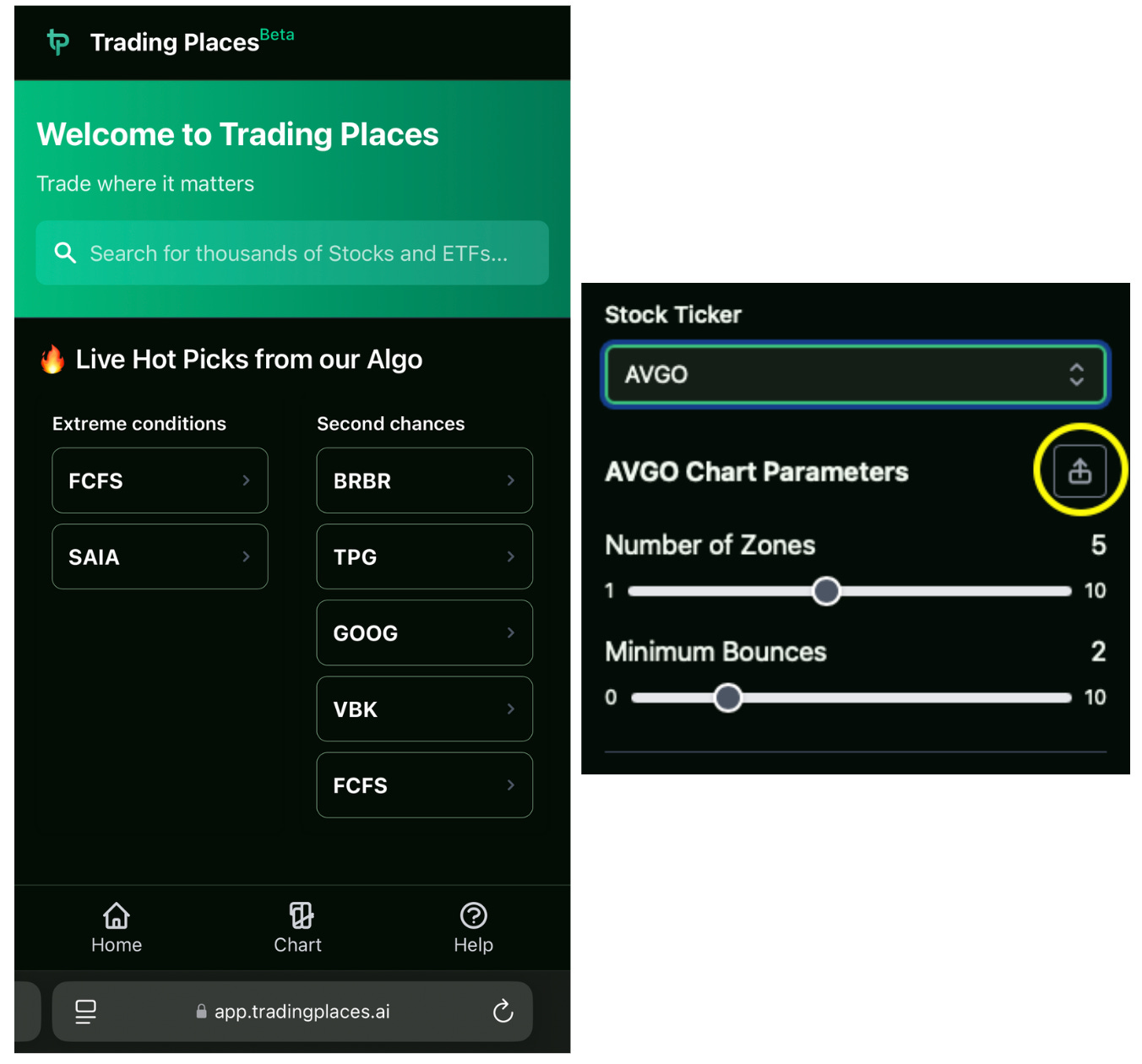

📱 Trading Places is now on mobile! Simply go to app.tradingplaces.ai on your phone’s browser to access the online tool.

📤 You can now quickly share your custom setups—complete with the Zone and Bounce filters—directly from the platform’s Chart tab.

This means it’s now easier to view, discuss, and share your zone trading setups and analysis.

Not on the beta yet? You can still be among the first traders to test it out:

Okay, let’s dive straight in.

New here? Welcome to Zone Alerts.

This is where we highlight stocks that are approaching key support and resistance zones and analyze where the action might lead.

These weekly alerts help you zero in on high-potential setups while keeping risk management in check.

What’s in this issue:

• This week’s three new hot zones

• What are zones?

Here’s what our zone algo picked up for you this week:

FirstCash Holdings Inc. (FCFS)

Financial • Credit Services • USA • NASD

View the chart

FCFS has had a pretty good 2025—up nearly 30% YTD despite the fairly rocky environment we’re in.

Right now, it’s knocking at the door of its April 2024 zone.

The last time price hit these levels, the stock didn’t fare too well—its multi-year uptrend got shot down hard, leading to a 13% single-day bloodbath.

But comparing this rally to 2024’s—volume this time around has been stronger. Nothing explosive… but noticeably higher than average, meaning the stock has momentum on its side.

But… with RSI already above 72, this trend is due for a quick breather. We would likely see some pullback to the $128-130 range before interesting things happen.

If demand holds, this could turn into a real breakout toward new highs.

Evergy Inc. (EVRG)

Utilities • Utilities - Regulated Electric • USA • NASD

View the chart

After a strong, clean rally that began in October 2023, EVRG is now sitting in a multi-year resistance zone from August 2021… a few dollars away from its ATH.

The stock has been trying its damnedest recently to penetrate this zone—to no avail. Each of the two previous retests ended up getting smacked back down to the September 2019 support.

And while there’s plenty of room to run before EVRG becomes overbought, you’ll notice that there’s a clear bearish divergence forming in its RSI.

And with volume looking quite limp lately, the likelihood that we’re in for another rejection from resistance is rising.

This sets up a possible swing back toward the September 2019 zone—for a potential 6-8% downside.

Cintas Corporation (CTAS)

Industrials • Specialty Business Services • USA • NASD

View the chart

For the past few months, CTAS just can’t seem to get away from its September 2024 resistance—showcasing just how much of a price draw zones can be.

Right now—of course—it has again managed to get itself stuck within the very same zone.

Yes, RSI is neutral at only 56, but as you can see below, it has failed to break above 60 on multiple rallies within this range.

Volume during this mini-rally has also been weakening—more traders are actually showing up at the lower end of the channel, i.e. they’re BTFD-ing.

This sets the stage for another potential bounce from resistance—where a slide back toward the July 2024 support could offer around 5% downside.

(And ideally, you’ll also ride the zone trade back up. But that’s for another alert)

WTF are Zones, anyway?

Zones are key price levels where the market has reacted strongly in the past—such as sharp reversals or sudden swings.

They’re areas where actual supply and demand met in the past, and likely will meet again.

“Why are these significant?”

Well, it all comes down to three key principles. We like to call them The Principles of:

When I Dip, You Dip, We Dip (aka psychology)

Traders are aware that others are watching these levels (zones) too. With everybody paying attention, this creates a self-fulfilling prophecy where everybody acts in anticipation of everybody else’s actions.

Markets Gonna Market ¯\_(ツ)_/¯ (aka technical factors)

If the first price rejection at the top of a zone was violent, it’s likely that buyers who entered at that level are now holding losses.

But with each retest, the rejection weakens, as there are fewer buyers remaining underwater. This weakens that resistance (or support for all you short-sellers), and could eventually lead to a break through.

Killer Whales (aka institutional plays)

Big players need liquidity in order to place massive orders without moving the market against themselves. So they wait for these zones, knowing a lot of us small fry (retail traders) will come to play.

This allows them to buy low or sell high without causing a lot of waves.

But remember: Zones are NOT guarantees but rather regions of increased probability for market moves. So always, ALWAYS use proper risk management.

Trading Places: Launch coming soon!

Stop obsessively refreshing your charts like it’s your ex’s Instagram.

By combining historical patterns with real-time market data, Trading Places identifies zones and assigns probabilities to each one—helping traders spot potential plays with higher chances of success.

It automates all of the curation, chart-plotting, and alerting for you, so you can actually have a life (or at least pretend to)!

Stay tuned!

Disclaimer: This isn't financial advice. This shouldn’t be news to you.