Hot zone alert - March 25 2025

Your weekly guide to the the most promising trade setups in stocks, crypto, and currencies

Hello, everyone.

Glad you could join us for another issue of Zone Alert.

With all the uncertainty and volatility swirling around the market lately—especially with April 2nd looming—trading “buzzy” stocks can sometimes feel more like a crapshoot.

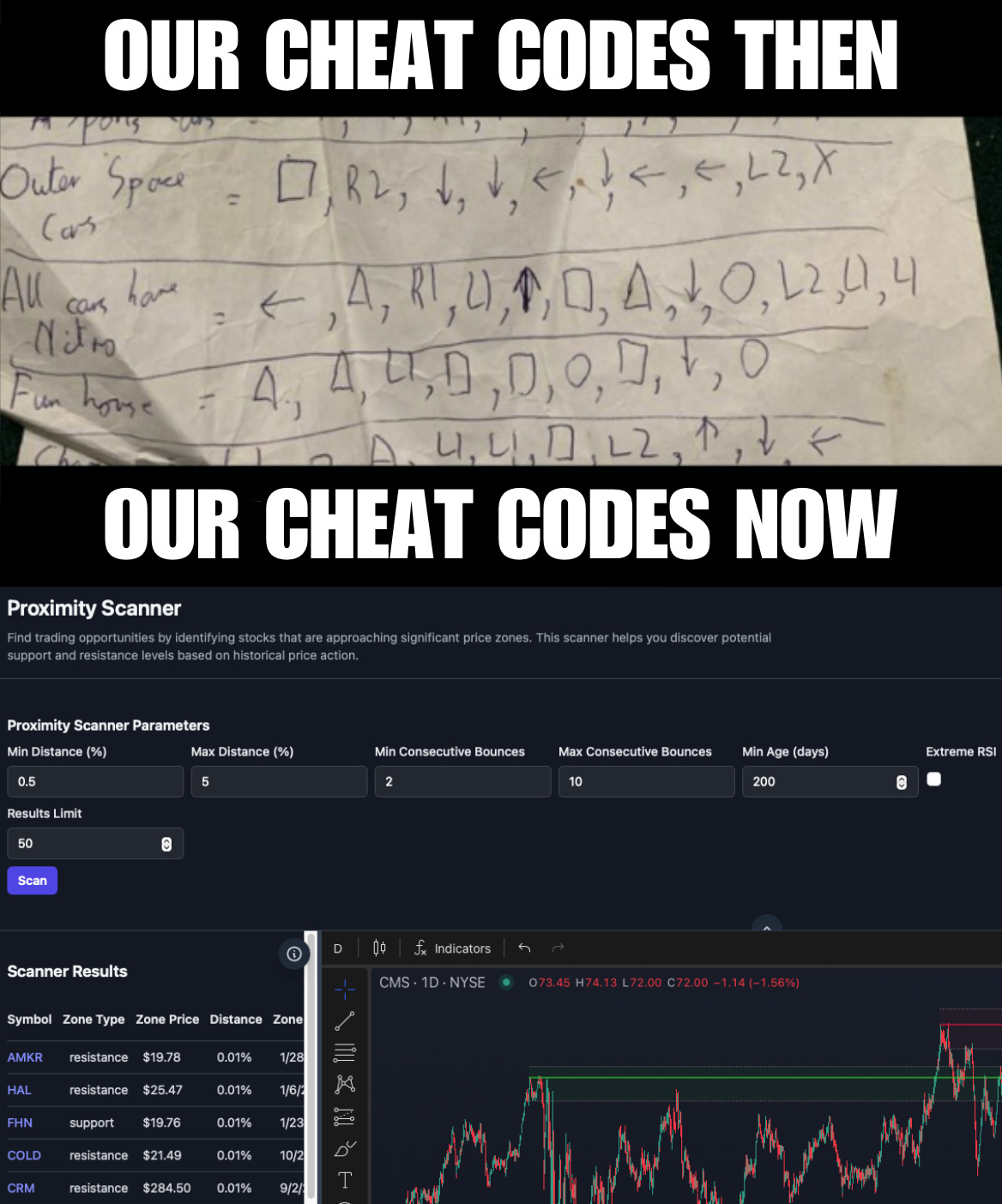

So this week, we’re including some less-talked-about stocks—to show that solid opportunities can be found anywhere, as long as you know where to look… also if you have a handy cheat code like our zone scanner.

Let’s check them out.

New here? Welcome to Zone Alerts.

This is where we highlight stocks that are approaching key support and resistance zones and analyze where the action might lead.

These alerts help you zero in on high-potential setups while keeping risk management in check.

If you want to get notified whenever a new one drops, subscribe to this newsletter!

What’s in this issue:

• This week’s three new hot zones

• What are zones?

Here’s what our zone algo picked up for you this week:

Antero Resources Corp. (AR)

Energy • Oil & Gas E&P • USA • NYSE

AR’s recent rally has been nothing short of impressive—managing to jump more than 22% in only 11 days.

But the stock stumbled a bit these past few days, as it approached its February 2015 resistance zone.

This particular zone that has a track record of killing momentum dead in its tracks, just like it did in January and February. Those retests resulted in 12% and 18% pullbacks, respectively.

There’s a chance this retest meets a similar fate.

Despite AR’s explosive move upward, volume has been quietly dropping day by day—possibly signaling waning enthusiasm. On top of that, RSI is creeping toward overbought territory.

All in all, this is shaping up to be a fairly promising short play with a favorable R/R ratio.

If AR indeed rejects this resistance, we could see it sliding down to the June 2024 zone, setting up a nice 11+% return.

But if the stock’s momentum picks back up, placing a stop a few ticks above the February 2015 zone (around $43) would keep potential losses tightly around 3-4%.

Graphic Packaging Holding Co. (GPK)

Consumer Cyclical • Packaging & Containers • USA • NYSE

The last time GPK tapped its March 2023 zone, the stock rebounded hard—running nearly 22% to reach an all-time high in just three weeks. Fun times.

But the stock might not be as lucky this time around.

This retest is looking decidedly iffier, thanks to a few… not-so-fun signals.

First is the somewhat rising volume during this recent sell-off—punctuated by the sudden volume dip yesterday, as the stock narrowly avoided a zone breakdown.

Second is the RSI. While already hovering in the mid-30s, it still has some room to sink further before reaching technically oversold levels (RSI bottomed at 28 during the previous retest).

If the zone gives way, GPK could make a quick slide down to the August 2022 support zone—offering a potential 6.3% move.

CMS Energy Corporation (CMS)

Utilities • Utilities - Regulated Electric •USA • NYSE

CMS’s April 2022 zone is a virgin resistance that’s been tried many times, but has not once budged.

For the past month, the stock has been hanging around within the zone, again trying (repeatedly) to penetrate above it.

Usually, these long consolidations and multiple retests can weaken a zone—wearing down sellers and allowing buyers to finally break through.

But that spike in selling volume the last couple of days tells us otherwise.

Worse still, each retest attempt looks to be weaker than the last, producing consistently lower highs and lower lows.

This setup still needs to unfold a bit more. But if CMS breaks decisively below its current zone—possibly within the next few days—our first potential target is the September 2019 zone, which would yield a roughly 7-12% gain.

WTF are Zones, anyway?

Zones are key price levels where the market has reacted strongly in the past—such as sharp reversals or sudden swings.

They’re areas where actual supply and demand met in the past, and likely will meet again.

“Why are these significant?”

Well, it all comes down to three key principles. We like to call them The Principles of:

When I Dip, You Dip, We Dip (aka psychology)

Traders are aware that others are watching these levels (zones) too. With everybody paying attention, this creates a self-fulfilling prophecy where everybody acts in anticipation of everybody else’s actions.

Markets Gonna Market ¯\_(ツ)_/¯ (aka technical factors)

If the first price rejection at the top of a zone was violent, it’s likely that buyers who entered at that level are now holding losses.

But with each retest, the rejection weakens, as there are fewer buyers remaining underwater. This weakens that resistance (or support for all you short-sellers), and could eventually lead to a break through.

Killer Whales (aka institutional plays)

Big players need liquidity in order to place massive orders without moving the market against themselves. So they wait for these zones, knowing a lot of us small fry (retail traders) will come to play.

This allows them to buy low or sell high without causing a lot of waves.

But remember: Zones are NOT guarantees but rather regions of increased probability for market moves. So always, ALWAYS use proper risk management.

Trading Places: Launch coming soon!

Stop obsessively refreshing your charts like it’s your ex’s Instagram.

By combining historical patterns with real-time market data, Trading Places identifies zones and assigns probabilities to each one—helping traders spot potential plays with higher chances of success.

It automates all of the curation, chart-plotting, and alerting for you, so you can actually have a life (or at least pretend to)!

Stay tuned!

Disclaimer: This isn't financial advice. This shouldn’t be news to you.