Recapping past zones (31 Jan 2025)

A follow-up to our weekly zone alerts

Well that was a week to remember, wasn’t it? Or maybe one to try and forget—especially if Monday’s tech dip did you dirty.

But the good news is, this business week has finally approached its tail end.

So as you all take a quick beat to strategize for next week, here’s the latest issue of our weekly Zone Update.

This time, we’re looking back at some the stocks we flagged in our January 14 and January 28 newsletters to see how they played out.

In case you’re new here, each week we highlight stocks nearing or entering Hot Zones, i.e. key levels on the charts with great risk-reward setups. Stay tuned and subscribe for future updates!

Check out our zone alerts for this week:

The Kraft Heinz Company (KHC)

Consumer Defensive • Packaged Foods • USA • NASD

Zone alert: January 14, 2025

When we flagged KHC, it had just rebounded off an old support level after seeing a big red candle the day prior. The bounce didn’t have a lot of conviction, to be honest—closing just 0.95% up.

What was notable, however, was where the retest occurred.

KHC’s May 2020 zone is a virgin zone—one that has been tapped but never penetrated since its formation. Moreover, every retest has historically led to very significant gains.

The zone remains pure to this day.

The stock has once again bounced off the zone, and is up about 4% since the alert.

However, for those who jumped in on this only for the short run—the retest of the March 2019 zone on January 27 would’ve been a decent exit at 6.5% gains.

NextEra Energy, Inc. (NEE)

Utilities • Utilities - Regulated Electric • USA • NYSE

Zone alert: January 14, 2025

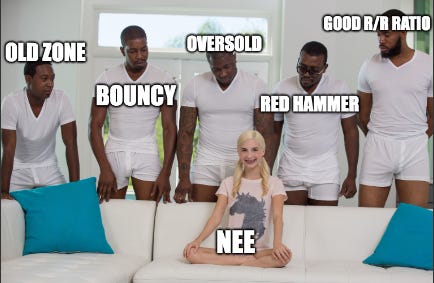

We claimed on our NEE zone alert that it was a textbook zone play, and boy was it ever.

Solid old support, a track record of rebounds, oversold RSI, buyers rejecting the price drop, plus plenty of room to run.

It was the perfect storm. Or whatever the opposite of a perfect storm is.

And NEE didn’t disappoint.

The stock broke through two resistance zones, and was up by as much as 10.6% on January 24 and 27—both excellent days to close the play.

Financial Select Sector SPDR (XLF)

Financial • Exchange Traded Fund • USA • NYSE

Zone alert: January 28, 2025

We’re still psyched about adding ETFs to our library that we want to mention them twice in one week.

Our scanner flagged XLF as it hovered just below its all-time high.

With strong volume that day and expectations that the Fed would hold interest rates steady, we figured a breakout seemed likely.

And break out, it did.

As of writing, XLF is in uncharted territory—a new ATH at $51.90. Sure that’s only about a percent gain since the alert, but with positive outlooks on upcoming economic data, there’s a good chance this upward move will still have some juice.

Even this week, our zone algorithm spotted three additional opportunities with compelling risk-reward potential.

To get these delivered straight to your inbox weekly, subscribe to our newsletter (a new zone alert is dropping this Tuesday)!

“But wait… who are you people and what am I doing here?”

Welcome to Trading Places.

We’re just a bunch of market nerds, quants, and posers who’ve stared at enough charts we dump our portfolios at the sight of a menorah.

After years of convincing ourselves that the lines and shapes we were plotting actually meant something, we finally figured it was time to upgrade our shtick a tiny bit.

So now, we get quant intelligence to do it for us.

We built an algorithm that’s deaf to the market’s siren songs. It cuts through the BS and pinpoints Zones of interest, i.e. places on the chart where actual money comes to dance.

Think of it as a Limitless pill for your stock, currency, and crypto plays—scanning the markets in real-time and determining where the action’s at.

WTF are Zones, anyway?

Zones are key price levels where the market has reacted strongly in the past—such as sharp reversals or sudden swings.

They’re areas where actual supply and demand met in the past, and likely will meet again.

“Why are these significant?”

Well, it all comes down to three key principles. We like to call them The Principles of:

When I Dip, You Dip, We Dip (aka psychology)

Traders are aware that others are watching these levels (zones) too. With everybody paying attention, this creates a self-fulfilling prophecy where everybody acts in anticipation of everybody else’s actions.

Markets Gonna Market ¯\_(ツ)_/¯ (aka technical factors)

If the first price rejection at the top of a zone was violent, it’s likely that buyers who entered at that level are now holding losses.

But with each retest, the rejection weakens, as there are fewer buyers remaining underwater. This weakens that resistance (or support for all you short-sellers), and could eventually lead to a break through.

Killer Whales (aka institutional plays)

Big players need liquidity in order to place massive orders without moving the market against themselves. So they wait for these zones, knowing a lot of us small fry (retail traders) will come to play.

This allows them to buy low or sell high without causing a lot of waves.

Remember: Zones are NOT guarantees but rather regions of increased probability for market moves. So always, ALWAYS use proper risk management.

Trading Places: Launch coming soon!

Stop obsessively refreshing your charts like it’s your ex’s Instagram.

By combining historical patterns with real-time market data, Trading Places identifies zones and assigns probabilities to each one—helping traders spot potential plays with higher chances of success.

It automates all of the curation, chart-plotting, and alerting for you, so you can actually have a life (or at least pretend to)!

Stay tuned!

Disclaimer: This isn't financial advice. This shouldn’t be news to you.