Recapping past zones (Mar 21 2025)

A follow-up to our weekly zone alerts

Hey everyone!

Thanks for joining us on this issue of Zone Updates. This is where we revisit some of the alerts we’ve made in the past—from our weekly newsletters, Substack Chat, or 𝕏—and see how the stocks reacted after interacting with a key zone.

In a market this choppy, finding good setups has gotten admittedly trickier.

And even when something looks perfect, things can still go sideways (heck, we’re already using a complex algo to help us spot good opportunities and we still get epically screwed from time to time… hi, TOL.)

So in this recap, we’re doing something a little different. Alongside our usual zone trading wins, we’re also going to break down a stock that didn’t go our way—and show how zones are still useful in these instances.

Let’s get started.

In case you’re new here, each week we highlight stocks nearing or entering Hot Zones, i.e. key levels on the charts with great risk-reward setups. Stay tuned and subscribe to get these alerts before anyone else!

Check out this week’s hot zones:

JPMorgan Chase & Co. (JPM)

Financial • Banks - Diversified • USA • NYSE

Zone alert: March 10, 2025

“Still a long way down 🔪” -@tradingplacesai on X

We caught wind of JPM when we saw 𝕏 chatter about company insiders offloading over $250M worth of stock since February. The stock had been on a wild nosedive since.

And while to some, this already seemed like a good buy-the-effin-dip opportunity… that glaring gap between current price and the August 2024 support zone was screaming at us.

We figured no one was going to catch this falling knife until it completes its traverse down to the zone.

True enough, JPM dropped another 7%—all the way to the bottom of the zone—before staging a rebound that’s just as sharp as the decline.

Advanced Micro Devices Inc. (AMD)

Technology • Semiconductors • USA • NASD

Zone alert: March 10, 2025

“AMD might actually be worth watching 👀” -@tradingplacesai on X

Waiting for a meaningful bounce from AMD has been a losing proposition lately. The stock’s beaten so badly since last year that no amount of macro tailwinds could inspire long-term confidence.

But our zone alerts, bonus or otherwise, are never about long-term anyway.

What we saw in AMD’s chart was that it was back at price levels from 2023, and at a support zone that has held up quite nicely the last time it was tested.

It had also spent several days retesting and consolidating near the September 2020 zone without breaking lower—hinting to us that there is indeed some strength to this zone.

And just a couple days later, it happened. As of writing, the stock is up more than 8% since the bounce.

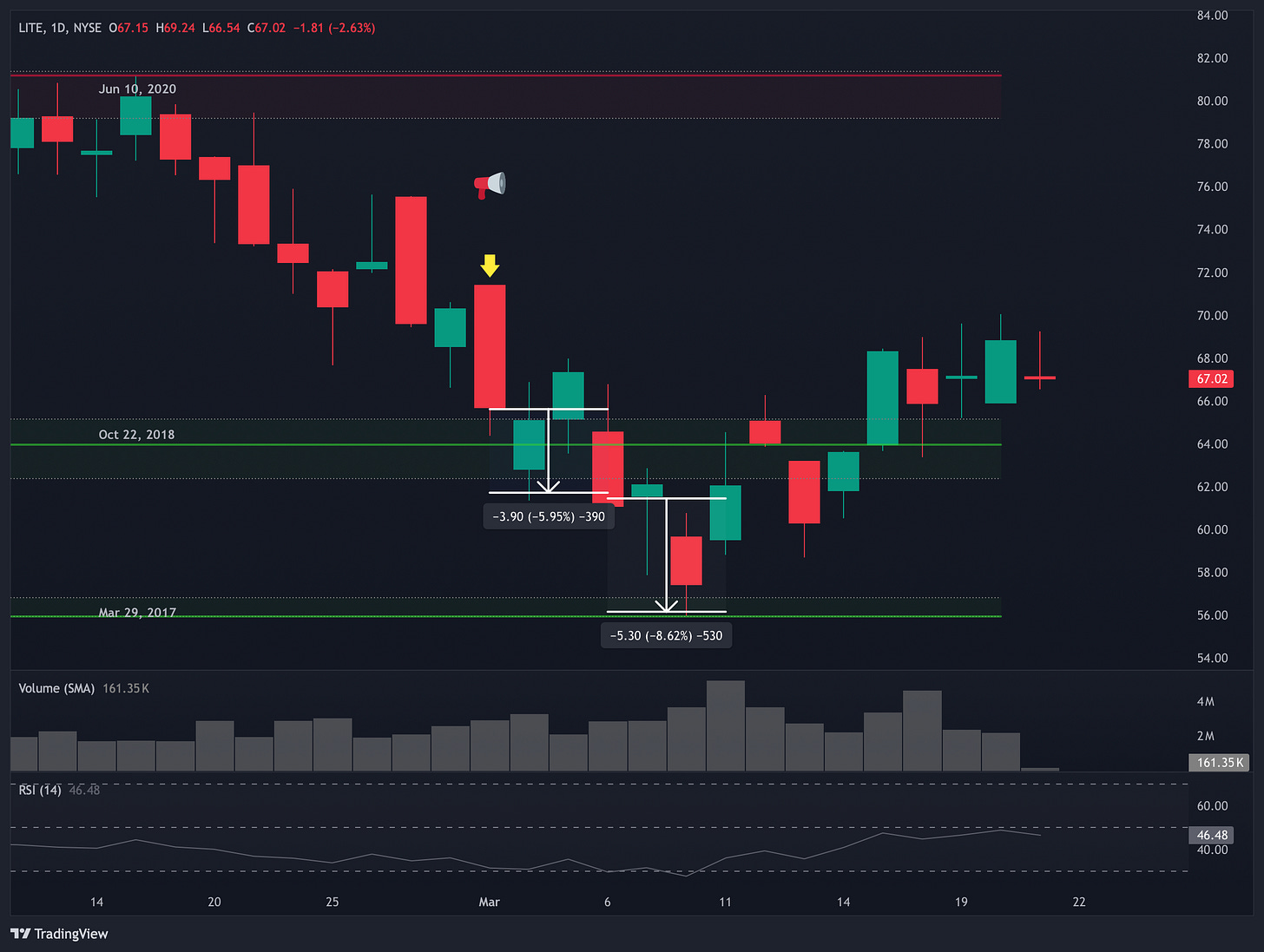

Lumentum Holdings Inc. (LITE)

Technology • Communication Equipment • USA • NASD

Zone alert: March 4, 2025

“If LITE bounces here, there’s a massive potential upside—a move back up to the February 2022 zone could net 20+%.

When our scanner found LITE, it was sitting on a support zone that, apart from being nearly 7 years old, would have remained un-penetrated as a support had it not been for a poor earnings showing in late 2022.

We estimated it had a solid shot at holding firm, possibly leading to a bounce toward its upper zones.

So… yeah. Obviously, it did not “net 20+%.”

But that’s actually the beauty of having zones to guide you…

Apart from serving as an early warning device for potential setups, zones also provide good entry and exit points for a trade.

In this alert, we also noted:

“But if it breaks, the downside risk is manageable. Setting a stop just below the zone would mean a loss of only 5-6%.”

And if you were in on this play, that stop below the zone would have saved you from incurring an additional 8.6% loss.

—

That’s it for this week’s recap, folks. Hope this gave you a better feel for how zones can help with risk management.

New setups coming your way on Tuesday! Until then, trade safe out there. 🫡

WTF are Zones, anyway?

Zones are key price levels where the market has reacted strongly in the past—such as sharp reversals or sudden swings.

They’re areas where actual supply and demand met in the past, and likely will meet again.

“Why are these significant?”

Well, it all comes down to three key principles. We like to call them The Principles of:

When I Dip, You Dip, We Dip (aka psychology)

Traders are aware that others are watching these levels (zones) too. With everybody paying attention, this creates a self-fulfilling prophecy where everybody acts in anticipation of everybody else’s actions.

Markets Gonna Market ¯\_(ツ)_/¯ (aka technical factors)

If the first price rejection at the top of a zone was violent, it’s likely that buyers who entered at that level are now holding losses.

But with each retest, the rejection weakens, as there are fewer buyers remaining underwater. This weakens that resistance (or support for all you short-sellers), and could eventually lead to a break through.

Killer Whales (aka institutional plays)

Big players need liquidity in order to place massive orders without moving the market against themselves. So they wait for these zones, knowing a lot of us small fry (retail traders) will come to play.

This allows them to buy low or sell high without causing a lot of waves.

But remember: Zones are NOT guarantees but rather regions of increased probability for market moves. So always, ALWAYS use proper risk management.

Trading Places: Launch coming soon!

Stop obsessively refreshing your charts like it’s your ex’s Instagram.

By combining historical patterns with real-time market data, Trading Places identifies zones and assigns probabilities to each one—helping traders spot potential plays with higher chances of success.

It automates all of the curation, chart-plotting, and alerting for you, so you can actually have a life (or at least pretend to)!

Stay tuned!

Disclaimer: This isn't financial advice. This shouldn’t be news to you..