Zone Alert: Div Plays with Discounted Entries (July 1 2025)

Your Quantamental guide to the the most promising trade setups in the market

Hey everyone,

Welcome to the second-ever issue of our Quantamental Zone Alerts—and honestly, we weren’t too sure this format would make it past the pilot.

We figured this mid-to-longer-term approach might not hit the same way as the classic, shorter-term alerts you’re used to.

But turns out… we couldn’t have been more wrong.

So at least for the time being, it looks like this new format is here to stay. And we’ve got a new batch coming your way.

New to our Quantamental zone alerts? Here’s everything you need to know:

Each week, we screen for longer-term setups using a Quantamental approach—basically combining quantitative techniques and solid fundamental analysis.

Using our different Quantamental screens, we surface high-potential names with a strong track record, trading at a discount—and of course, with the timing lining up in our favor.

Last week, we used a mix of ROIC, Growth, P/FCF, and Zones to find five promising stocks:

This week, here’s what we’re looking for:

Dividend yield (>4%)

We want businesses that consistently return real capital to shareholders. A solid div yield signals financial health, cash flow stability, and management confidence. These payouts can also provide a bit of downside cushion—which, in this kind of market, is invaluable.Payout ratio (<100%)

This tells us that a good chunk of a company’s earnings are being returned as dividends. These names typically have consistent cash flows or operate in mature industries. We’re looking for firms that prioritize shareholder returns—without completely bleeding themselves dry.Attractive valuation (P/FCF near 5-year lows)

A good business is great. But a good business trading cheap is even better. We want names where the market hasn’t caught up yet—measured by how low their Price-to-Free Cash Flow is compared to the past few years.Approaching key zones (near a strong support or resistance zone)

Once the fundamentals check out, we look to the charts. Zones help us time our entries—whether it’s a bounce or a breakout, we want to be there before the move starts.

Btw, you can replicate our first three Quantamental criteria using any stock screener out there (we’re using Koyfin, but you can also use free ones like Finviz).

As for which stocks are nearing zones, you can find all that and more in the Trading Places platform:

What’s in this issue:

• High-potential opportunities

• This week’s most actionable setup

• What are zones?

Our Quantamental screen results

Here are some of the names that popped up on our screens this week:

1. Verizon Communications Inc. (VZ)

Div Yield (Ind): 6.26%

Payout Ratio (FY): 64.26%

P/FCF (5Y Rank): 7th percentile

2. United Parcel Service, Inc. (UPS)

Div Yield (Ind): 6.50%

Payout Ratio (FY): 93.38%

P/FCF (5Y Rank): 21st percentile

3. PepsiCo, Inc. (PEP)

Div Yield (Ind): 4.31%

Payout Ratio (FY): 75.47%

P/FCF (5Y Rank): 3rd percentile

4. The Kraft Heinz Company (KHC)

Div Yield (Ind): 6.20%

Payout Ratio (FY): 70.37%

P/FCF (5Y Rank): 6th percentile

Most actionable setup this week: PEP

Consumer Defensive • Beverages - Non-Alcoholic • USA • NASD

PEP isn’t the sexiest and trendiest stock in the market, but that’s kind of the point.

While everyone on WSB and X are flipflopping between the PLTRs and the HOODs of the world, Pepsi’s just… there—trudging by, printing, and consistently returning it to shareholders.

Right now, PEP is yielding 4.31% and paying out just a bit over 75% of its earnings.

Not too aggressive that they’re stretching themselves thin, but still generous enough to matter to hodlers. It means they’re still leaving room for flexibility and reinvestment—also hallmarks of a well-run, capital-disciplined business.

It’s exactly the kind of dividend profile you’d expect from a steady, cash-rich behemoth like PepsiCo.

As for valuation, right now PEP is trading at ~$133, with a P/FCF in the 3rd percentile vs. its past five years. In other words, you’re getting this gem at one of its cheapest levels in recent history.

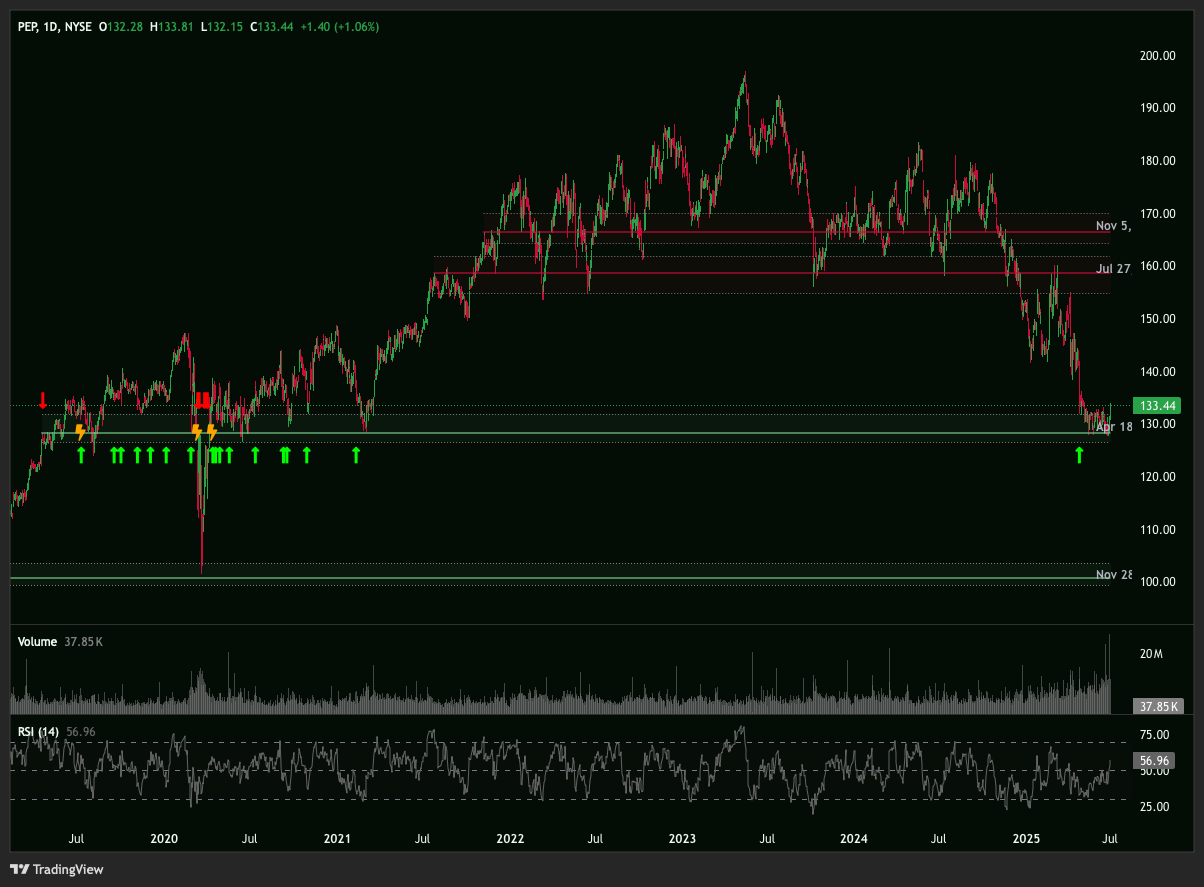

Next, looking at our zone chart, you’ll see that PEP has recently bounced off the April 2019 support zone.

This is a key zone that has not broken since the COVID crash. It’s also where PEP has been consolidating tightly since May.

That it’s finally managed to break away from it could signal a potential turnaround for the stock—if it holds, that is.

This isn't a “to the moon” play—but well, it’s not really supposed to be. This one’s more about durability, divs, and a dependable setup for longer-term players.

That’s it for today’s issue of our all-new Quantamental Zone Alert. We’ll be back next week with fresh setups nearing key zones.

In the meantime:

Want to find more immediate setups?

The Trading Places platform is live—and free! Head on over and check out the Zone Scanner and Live Hot Picks.

Enjoying this new format of Zone Alert?

🖤 Hit the like button and let us know!

Still prefer the old one? We’d love to hear your thoughts—join our subscriber community to drop your feedback. You can help us shape what comes next!

Disclaimer: This isn't financial advice. This shouldn’t be news to you.